Have you ever received a document labeled as a proforma invoice and wondered what it really means? Understanding proforma invoice meaning is essential for anyone dealing with business, online orders, or international trade. While it sounds official, many people confuse it with a standard invoice. In this guide, we break down the meaning of a proforma invoice, show real-life examples, explain its uses, common mistakes, and even related business terms. By the end, you’ll fully understand what a proforma invoice is and when it should be used.

What Does “Proforma Invoice Meaning” Mean?

A proforma invoice is a preliminary bill or quote sent by a seller to a buyer before the goods or services are delivered. It’s not a final invoice, but it gives the buyer a clear idea of the costs involved.

Key Points:

Shows the price of goods or services

Lists quantities, descriptions, and sometimes shipping costs

Often used for customs or international trade

Helps the buyer confirm the order before payment

Origin & History:

The term “proforma” comes from Latin, meaning “for the sake of form”. In business, it’s been used for decades to provide buyers with a formal cost outline before actual invoicing.Difference from Regular Invoice:

Regular invoice: A demand for payment after goods/services are delivered

Proforma invoice: A quotation or estimate, not a legal demand for payment

How People Use “Proforma Invoice Meaning” in Real Life

Proforma invoices are common in:

Business Transactions: Exporters and importers use them to clarify costs before shipment.

Online Orders: Large orders may require a proforma invoice to approve payment or shipping.

Accounting & Bookkeeping: Helps companies plan payments and budgets.

Customs Clearance: Required for international shipments to calculate duties or taxes.

Appropriate Usage:

Formal business communications

Order approvals

Customs declarations

Inappropriate Usage:

Casual conversations or personal payments

When expecting a legal invoice for completed goods

Real-Life Examples of Proforma Invoices Meaning

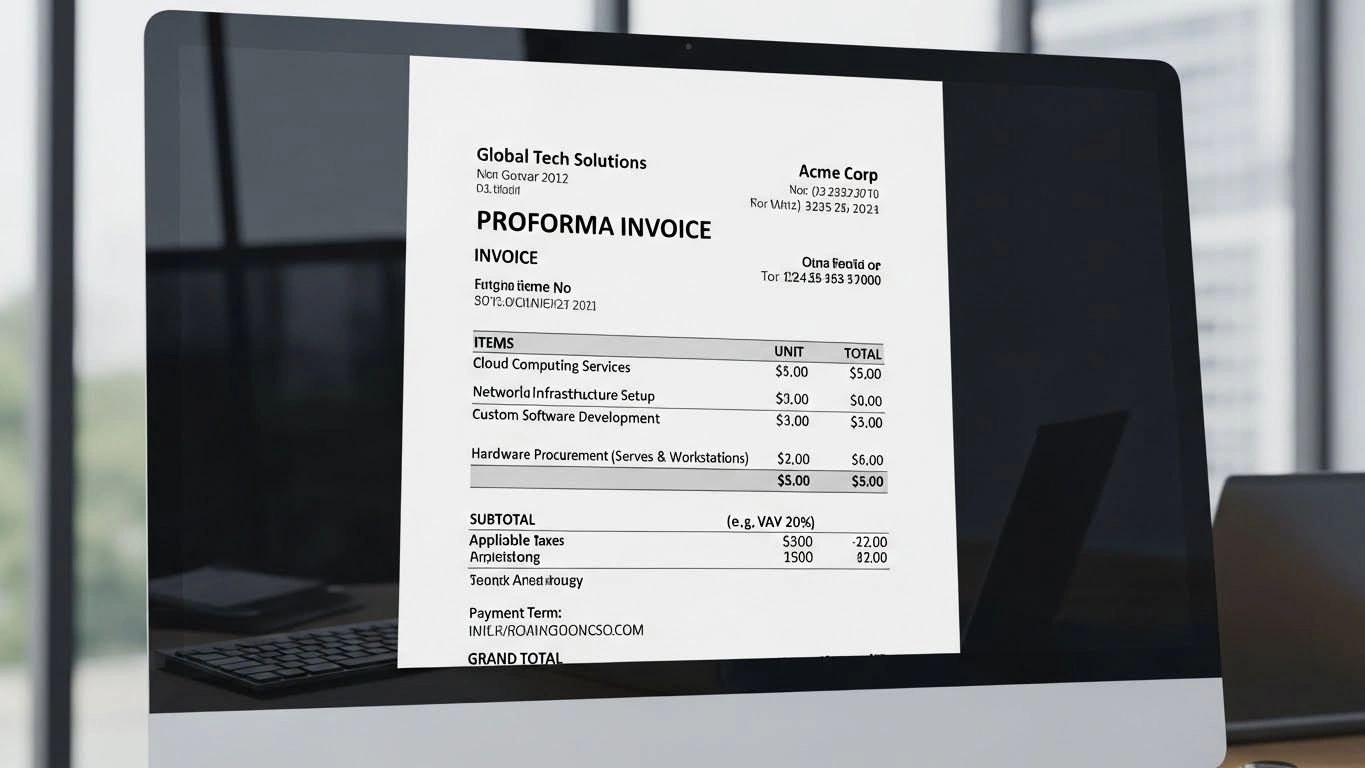

Here are examples of how a proforma invoice might appear in real life:

International Trade Example:

Seller sends a proforma invoice to buyer:

100 T-shirts @ $5 each

Shipping: $50

Total: $550

Buyer reviews it and confirms the order.

Online Supplier Example:

Buyer wants 50 laptops from an overseas supplier.

Supplier issues a proforma invoice listing costs, taxes, and shipping before actual shipment.

Small Business Example:

Freelance designer sends a proforma invoice for a website project:

Design fee: $500

Hosting: $100

Total: $600

Client approves and pays a deposit before work begins.

Customs Documentation Example:

Shipping company requires a proforma invoice to calculate import duties.

Budget Planning Example:

Company requests a proforma invoice to forecast project expenses before placing a bulk order.

Common Mistakes & Misunderstandings

Confusing Proforma Invoice with Final Invoice:

A proforma invoice is not legally binding for payment, unlike a final invoice.Skipping Proforma Invoices in International Trade:

This can cause delays in customs or unexpected charges.Incorrect Details:

Missing descriptions, quantities, or shipping costs can confuse buyers.Using It for Personal Transactions:

Proforma invoices are formal business tools and not suitable for casual payments.Not Updating Currency or Taxes:

Especially important for international buyers to avoid miscalculations.

Related Terms & Abbreviations

Invoice: Final bill requesting payment

Quotation (Quote): Similar to a proforma invoice but less formal

Purchase Order (PO): Document from buyer confirming order

Packing List: Shows items shipped, often accompanies the invoice

Commercial Invoice: Final invoice used for customs and accounting

Understanding these related terms helps avoid confusion and ensures smooth business operations.

FAQs

What is a proforma invoice?

A proforma invoice is a preliminary bill sent before goods or services are delivered. It shows prices, quantities, and sometimes shipping costs but is not a legal demand for payment.

Is a proforma invoice legally binding?

No, it’s mainly for informational and planning purposes. The final invoice is legally binding.

When should a proforma invoice be used?

It’s used before confirming orders, especially in international trade, customs, or large purchases.

How is it different from a commercial invoice?

A commercial invoice is the final bill used for payment and customs clearance, while a proforma invoice is just an estimate or quote.

Can a proforma invoice help with taxes or customs?

Yes, it provides necessary details like value, quantity, and description of goods for customs declarations and tax planning.

Conclusion

Knowing the proforma invoice meaning is crucial for business owners, buyers, and anyone involved in international trade. It clarifies costs, prevents misunderstandings, and ensures smoother transactions. Next time you receive a proforma invoice, you’ll know it’s a preliminary estimate, not a final bill, and how to use it properly.