If you’ve ever looked at a company’s financial report, you might have seen the term EBIT and wondered what it means. The EBIT meaning can seem confusing at first because it’s a technical term used in finance and accounting. EBIT is an important measure for understanding a company’s profitability before interest and taxes. Whether you’re a business student, investor, or just curious about finance, knowing what EBIT is can help you interpret financial statements and make better business decisions. This article explains the meaning of EBIT in simple English, with clear examples, real-life applications, and common mistakes. Updated for 2026, it’s designed for beginners and anyone learning business or finance terminology.

What Does “EBIT Meaning” Mean?

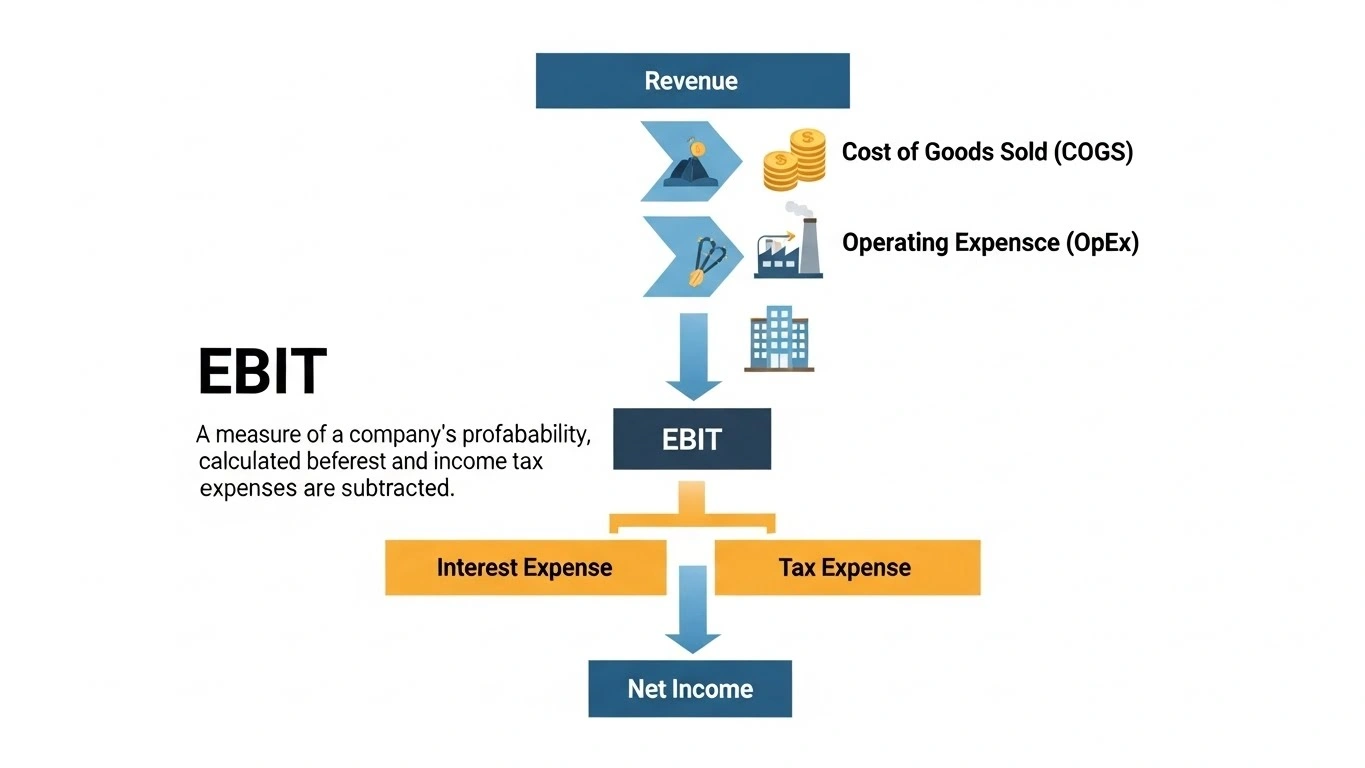

EBIT stands for Earnings Before Interest and Taxes.

In simple terms:

EBIT = Profit a company makes from operations before paying interest and taxes

It shows the company’s operating performance without the effects of financing or taxation.

EBIT Meaning in Simple English

EBIT measures how much money a company earns from its core operations.

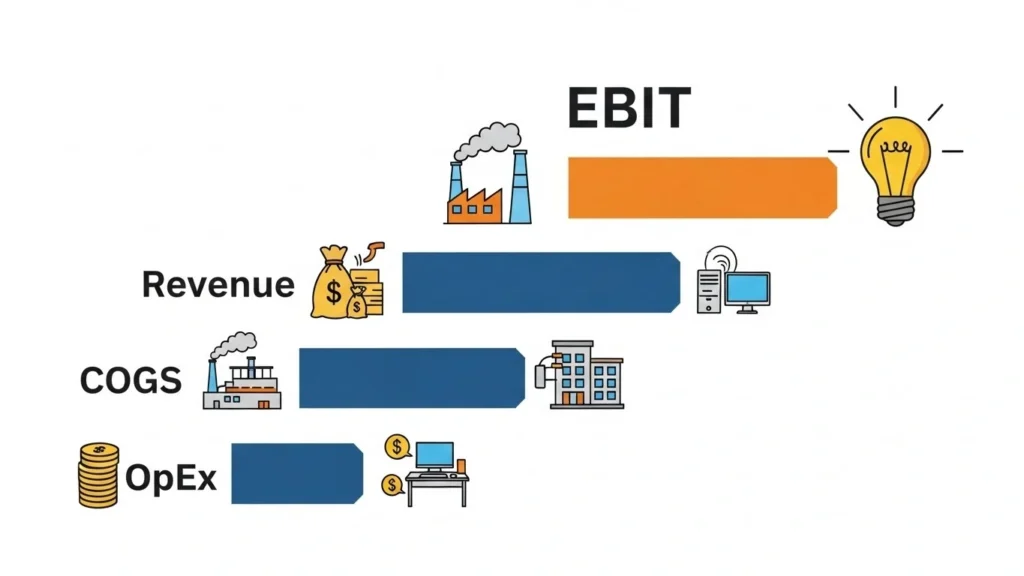

Formula:

EBIT = Revenue – Operating Expenses

or

EBIT = Net Income + Interest + Taxes

It’s sometimes called operating profit.

Why EBIT Meaning Is Important

EBIT is widely used in finance because it:

Shows operational efficiency

Helps compare companies without tax or debt differences

Assists investors in understanding profitability

Supports business decisions like budgeting or investment

Example:

Two companies earn the same revenue, but one has more debt. EBIT helps compare performance without considering interest.

EBIT vs Other Profit Measures

Understanding EBIT is easier when you compare it with other financial metrics.

EBIT vs EBITDA

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization

Difference: EBITDA ignores depreciation/amortization; EBIT includes them

EBIT vs Net Income

Net income = Profit after all expenses, interest, and taxes

EBIT ignores interest and taxes, focusing on operational profit

EBIT vs Operating Income

Sometimes EBIT and operating income are used interchangeably

Operating income typically comes from core business only, excluding non-operating items

How People Use “EBIT Meaning” in Real Conversations

EBIT is used mostly in business, investment, and accounting discussions.

Common Situations

Company financial reports

Investor analysis

Business meetings

Accounting courses

Online finance articles

Example Sentences

“The company’s EBIT increased by 15% this quarter.”

“Investors look at EBIT to gauge operational performance.”

“EBIT excludes taxes, so it’s easier to compare internationally.”

Real-Life Examples of EBIT Meaning

Example 1: Simple Company

Revenue: $500,000

Operating Expenses: $300,000

EBIT = $500,000 – $300,000 = $200,000

Explanation:

The company earned $200,000 from its operations before interest and taxes.

Example 2: Including Taxes and Interest

Net Income: $150,000

Interest: $20,000

Taxes: $30,000

EBIT = $150,000 + $20,000 + $30,000 = $200,000

Explanation:

This method calculates EBIT starting from net income.

Example 3: Comparing Companies

Company A EBIT: $500,000

Company B EBIT: $300,000

Even if Company B pays less tax or interest, Company A’s operational performance is better.

Example 4: Startup Scenario

Startup revenue: $50,000

Expenses: $40,000

EBIT = $10,000

Shows operational profit before financing costs.

Example 5: Investor Analysis

“EBIT margin is 25%”

Indicates that for every $100 of revenue, $25 comes from operations before interest and taxes

Common Mistakes and Misunderstandings

Confusing EBIT With Net Income

Mistake:

Thinking EBIT = Profit after tax

Correction:

EBIT ignores taxes and interest. Net income includes them.

Forgetting Non-Operating Income

Mistake:

Including non-operating gains or losses in EBIT

Tip:

EBIT focuses on operational earnings

Using EBIT Without Context

Mistake:

Comparing EBIT of companies in different industries blindly

Tip:

Compare EBIT margins, not absolute values

Confusing EBIT With EBITDA

Mistake:

Using EBIT and EBITDA interchangeably without checking depreciation

Correction:

EBITDA ignores depreciation/amortization; EBIT includes it

Related Financial Terms

Revenue – Total income from sales

Operating Expenses – Costs of running business

Net Income – Profit after all costs, interest, and taxes

EBITDA – Profit before interest, taxes, depreciation, and amortization

Operating Margin – EBIT as a percentage of revenue

These terms often appear together in financial reports.

FAQs

What does EBIT meaning mean in simple words?

EBIT means earnings before interest and taxes; it shows operational profit.

Is EBIT the same as operating income?

Almost. EBIT often equals operating income but can include non-operating items in some reports.

Why is EBIT important for investors?

It shows how profitable a company is from core operations, ignoring tax and financing differences.

How do you calculate EBIT?

EBIT = Revenue – Operating Expenses or EBIT = Net Income + Interest + Taxes

Can EBIT be negative?

Yes. If operating expenses exceed revenue, EBIT is negative, showing a loss from operations.

Conclusion

The EBIT meaning is simple once you understand it: it’s the profit a company earns from its operations before interest and taxes. It’s a key measure for investors, business owners, and finance students to evaluate operational performance without external factors affecting the numbers. Understanding EBIT helps you interpret financial reports, compare companies, and make smarter business decisions.